Business Value Drivers: Making your business more valuable now and later

Entrepreneurs start businesses as a way to create current and future profits. When the time comes for the owner to exit, the value of the business to a buyer will be determined by how much future cash flow a the business can generate.

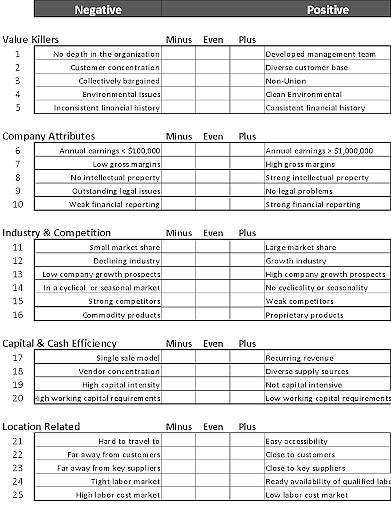

Building long-term value should be the goal of every business owner, from start to finish. following is a list of 25 “Value Drivers.” These attributes and characteristics either increase or decrease a business’ value, today, next year, the year after, and at a final sale.

An important thread that runs through this list is that risk is bad for value; stability and predictability are good for value.

• Value Killers. Pay attention to these characteristics that can kill a private business!

Depth in the management of the business is critical. Loss of a key employee, or death of the owner, can put a small business into a tailspin. Building real depth may take a long time for a new company, but it is important to understand that management depth is essential to the survival of the business.

Customer concentration is risky when more than 20% of your business comes from one customer. The top three customers should account for 30% or less of total sales to reduce risk. There is a boneyard of businesses who grew with one big customer that suddenly changed direction and stopped buying.

Collectively bargained employees are a negative force on the business. Uncertainty of future wages, work rules, and benefits reduce future profits and today’s value.

Environmental issues have unknown future costs and restrictions that can hurt earnings. An environmental mess can be deadly.

Inconsistent financial history makes future expectation of earnings uncertain. Up-and-down historical profitability reduces expectations of consistent future cash flow. Even if the “ups” are good, the “downs” can be worse.

• Company Attributes. Basic characteristics that add or subtract value.

Company annual earnings <$100,000 are risky because the small earnings have little cushion from break-even earnings or even lose money in response to small external factors. Companies with >$1,000,000 earnings are much more protected from a loss year.

Gross margins below 30% reduce values because it is less profitable for the company to expand revenue. On the other hand, gross margins >50% indicate a strong business model with better long-term earnings potential.

Intellectual property (patents, processes, know-how, trade secrets) have a positive effect on business value since they give the company exclusive rights to things that improve overall earnings.

Legal issues affecting the company, either as a plaintiff or defendant, drive down value. Right away, expenses of a lawsuit are a direct reduction to bottom line earnings. Ultimate settlement of the claims may restrict the company’s sales and/or profits.

Good accounting records give the owner the tools necessary to maximize profits. In addition, if the owner is interested in selling the company, good historical financial statements that are easy to understand will increase the value to a buyer.

• Industry and Competition. The nature of a company’s industry and the company’s role in it affect future earnings.

Market share affects a business’s ability to be a price leader and to influence sales and profits. Companies with large market share are typically more profitable than companies with small share.

Industry direction, whether growing or contracting, affects the company’s expected future earnings projections.

Company growth prospects separate from the industry (new products, new technology) can promote increased earnings. It may be OK to be in a stagnant industry if the business has a way to grow in spite of the overall marketplace.

Cyclical or seasonal markets need planning and careful management to be successful at market peaks while preserving people and profits during downswings.

Commodity products make it hard for management to achieve strong gross margins. Proprietary products give the business a basis for higher price and larger market share.

• Capital and Cash Efficiency. Different businesses can have different needs for long-term capital (loans, earnings) to support future earnings.

Single-sale businesses (like funeral homes) have to find new customers every day. “Recurring Revenue” businesses, like health clubs, charge their customers’ credit cards every month whether they use the gym or not. Most businesses are somewhere in between, but the more repeating customers, the smoother the earnings.

Vendor concentration is bad, just like customer concentration. Companies that are sole sourced on key products or components are at risk of losing future earnings. The supply chain disruption of the COVID pandemic demonstrated the weaknesses of dependence on one or two key suppliers that hold the keys to your sales.

High capital equipment requirements for heavy manufacturing operations have a continuing demand for expensive machinery to grow the company. In contrast, service businesses can grow just by adding additional employees.

Working capital (inventory, accounts receivable) requirements can also affect value. Health-care providers often have to wait three months for Medicare and health insurance companies to reimburse their services, but they have to pay employees weekly. Delayed payment terms consume additional working capital compared to a service provider who gets paid by credit card right away.

• Location Related. For brick and mortar businesses, it is important to understand that certain location factors affect future earnings.

Hard-to-travel-to locations are often less profitable because supplies are more expensive and expanding the business outside its home territory is harder.

Customer proximity makes a difference in earnings due to better communications, faster response time, and quick-turn deliveries.

Supplier proximity is also a factor in costs and profits. Manufacturers of products that use a lot of steel are often strategically located near steel mills. Companies that process seafood are typically located in coastal areas.

A tight labor market can cause lower profits due to higher wages. On the other hand, moving operations to a region with good labor resources can improve profitability.

High labor costs have a direct effect on profitability. Some businesses become constrained by lack of good employees, regardless of the costs.

Applying these factors to your business does not have to be an immediate shift in directions. Instead, consider these Value Drivers to be part of your long-term value-building program.

Building good organizational depth can take 10 to 20 years.

Other items can be addressed more quickly. Every business owner can evaluate customer and vendor concentration today and decide if and how to reduce reliance on these critical relationships.

Some of these are cautionary: avoid lawsuits, take care of environmental issues, improve the quality of your financial reporting so that these weaknesses don’t drag down your value.

Some business attributes, like location, are un-changeable. Don’t worry about what cannot be changed. Focus your value-building efforts on things that you can change like improving the products or services.

Value Drivers are summarized in the table below. Use This form to score your company on positive and negative attributes. Focus on improving one, two, or three attributes this year, and a few more next year. Start with easy ones, then tackle others later. As this list shows, every business has flaws, but your business can always get a little better, and that’s a good thing.

Want to learn more about managing your business? At the North Idaho College’s Small Business Development Center, our mission is to help your business thrive and grow. Risk reduction is just one aspect of fulfilling that mission. No cost, one-on-one coaching in Leadership Development, Strategic Planning, Budgeting, Digital Marketing, e-Commerce, and other tools are available to take your business to the next level. Contact the NISBDC at 208-665-5085 or visit NISBDC.com.

• • •

John Hammett, is a Business Coach at the North Idaho Small Business Development Center. Over his career, he has served as an executive, owner, investor and adviser with entrepreneurial companies.

• • •

MAY CLASS SCHEDULE

Weekly Webinars — Wednesdays at 8 a.m.

Special topics for Business Leader

Value Based Pricing; May 4; taught by Warren Mueller

Writing a 3-year Business Plan; May 11; Dennis Weed

SPECIAL EVENT — LUNCH AND LEARN

BOOKKEEPING BASICS

WEDNESDAY, May 25, noon to 1 p.m.

ON-LINE — Business Accelerator Series

Fridays — 8:30 a.m. to noon

Marketing Strategy for Profit; May 6; Deborah Dickerson

Managing Financials for Profit; May 13; Bill Jhung

Operations for Excellence/Hiring Winners; May 20; Dennis Weed

Digital Marketing Strategy; May 27; Jamie Morgan