Welcome to the Holocene Epoch

As I write this column the first week of January 2023, the real estate market is still a disaster. It is not “plummeting” (a favorite media headline term.) In fact, prices here in North Idaho remain stubbornly high given the lackluster demand from buyers.

The market is more like a frozen landscape, reflecting the winter conditions outside my door. I am usually awake about 3 a.m. every morning. I step outside and it takes my breath away, at once bitter cold and terrifying and peaceful. Frozen solid. Nothing moves, except the wind occasionally howls.

I suppose if I lived in Scottsdale the tone of this article would be different. But in January, we are already a couple of weeks past the Winter Solstice. Once we cross that threshold of the day with the fewest daylight hours, we gain about 90 seconds to two minutes of daylight each day going forward. We are inexorably moving toward the light! Hold that thought, as things are going to stay frozen in a real estate Ice Age for a while and we will need optimism as we navigate a changed market.

About 60% of buyers use mortgage financing in purchasing their home. For at least the next six months, the general consensus of the market is that mortgage rates will remain between 5 and 7%. Buyers will reflect the reality of the increased monthly payments as they search for homes that suit their budget. Many other would-be buyers will be sidelined by qualification criteria. They simply cannot proceed. If you toss in the wave of job losses across many industries, and the looming threat of a recession (which I believe we are already in), that further removes prospective buyers from the market. In the face of this withering demand, prices will begin to thaw, just in time for spring.

The limited inventory situation, which has been supporting high prices, will also resolve. I suspect there is a significant build-up of potential properties coming to market. Individual sellers and developer-builders can only hold on to product for so long. And once the decline in prices begins to gain momentum, it will generate a re-set with sellers on the same scale as the re-set in mortgage rates has done with buyers. It’s not just facts that have to change, it’s perceptions as well that must shift.

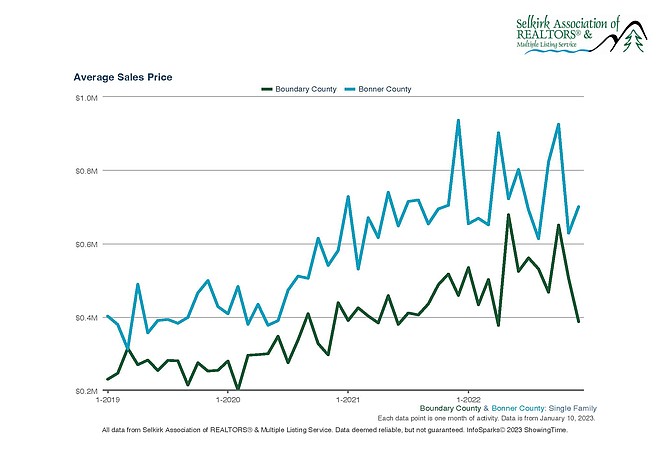

I've included a few interesting charts prepared by Brent Stevens of Century 21 Riverstone. The charts represent the past four years' activity in the Selkirk Association MLS which includes both Bonner and Boundary County. I looked at the data for the Coeur d’Alene MLS area and it tracks these graphics as well, the same erratic movements, but at four times the scale given the larger market.

Each of the charts shows the dramatic moves the market made over the past four years. I might have simply put up a chart of the roller coaster at Silverwood; it would look like the same ups and downs. And what is most noticeable is that after the wild ride, we are more or less back to where we started from, other than the average price is significantly higher, for now at least.

If buyer demand is to pick up, new ways to deal with the higher mortgage rates will begin to come on stream. I recently wrote about adjustable-rate mortgages as a way for buyers to temporarily cushion the effects of the surging interest rates. There is another similar approach: mortgage buydowns. Generally considered a seller concession, mortgage buydowns involve sellers/home builders contributing cash at closing to lower a buyer’s mortgage rate by one to three points. The contribution is placed in an escrow account to pay part of the monthly mortgage payment.

There are various approaches. For example, in a 2/1 program, the buyer’s effective rate is lowered in the first year by two percentage points, then one percentage point in year two, and in year three, the rate goes back to the more permanent level. There is an obvious advantage in the early stages of this approach, but the buyer needs to be confident they can meet the re-set obligation when the subsidized rate goes away. Lenders are qualifying buyers based on the re-set rate, so there is at least on paper, the awareness that the carrying costs will eventually increase.

Meanwhile, on the demand side, the factors that drove heightened migration levels to what was a rural and remote North Idaho paradise have largely played out.

Apparently, the COVID virus is still with us, mutating and causing havoc in certain demographics, but in true American style, we’ve grown bored with it and moved on. It has ceased to be a cause of fear and panic motivating flight to safer places than the congestion of large metro areas. And the work-from-home movement is waning too. It’s interesting that major employers across the US are now trying to stuff the toothpaste back into the tube, and force employees back into the office, back into morning commutes sitting in dense traffic heading to decaying downtowns.

But moving to North Idaho is very much a change in lifestyle for the urban escapees, bordering on culture shock. The surge in newcomers is so recent that there hasn’t been time for certain implications to play out. Implications like long cold gray winters, like quiet and deserted streets on most weekday evenings, like all these trees and rocks and open spaces, which can be psychologically disorienting when one is used to the overt stimuli of a city. There will be a certain percentage of attrition as the reality of North Idaho sets in.

We are very much in a transition zone now. Once a place has been “discovered” it’s impossible to go back to undiscovered. This is not necessarily a bad thing. After all, we create our own reality. Our community reflects our collective choices and actions. The challenge for the small communities of North Idaho is to assimilate the new energies that have come to us and embrace those two minutes of daylight we are gaining every day as we keep moving forward into the light.

The most recent glaciation period, often known simply as the “Ice Age,” reached peak conditions some 18,000 years ago before giving way to the interglacial Holocene.

Raphael Barta is an associate broker with an active practice in residential, vacant land, and commercial/investment properties. He can be reached at raphaelb@sandpoint.com.